You’ve worked hard to find your next great hire – now, it’s time to turn to that stack of new employee forms. That process can feel daunting for many small to midsize businesses. It takes a lot of time, energy and patience to find the right employee, much less manage all those required, often overwhelming, new hire forms. All of which must be done efficiently and accurately.

That pile of new hire forms builds quickly, and includes:

- An Employment Contract

- An Employee Identification Form

- IRS-required forms, including an I-9 and Form W-4

- A Background Check Authorization Form

- A Direct Deposit Form

- An Employee Handbook, with Acknowledgement of Receipt Form

And that’s not all. The full range of new employee forms varies depending on your business type and work environment, your benefits offerings, and the type of hire (full-time, part-time or contract).

So how does a small to midsize business ensure they’re dotting all the i’s and crossing all the t’s when it comes to managing new hire forms, alongside all the other day-to-day responsibilities that come with running a business?

Here’s a checklist to help your business be better prepared, better informed, and more efficient in managing its new employee forms. Because the more successfully you onboard your new employees, the faster you’ll see results for your business.

Preparing to Onboard a New Employee

Before you even begin to hire employees or think about new hire forms, it is critical that your business understands the hiring process steps and is meeting current employment laws and regulations, fulfilling IRS requirements, and has a system in place for employee record-keeping.

- If you’re a new business, you’ll want to be sure to have obtained your Employee Identification Number (EIN), and have also registered with the Electronic Federal Tax Payment System (EFTPS), which allows you to pay any taxes due to the IRS.

- Keep yourself familiar with Federal and State employee laws, as well local labor regulations.

- Visit the United State Department of Labor’s website (DOL) to educate yourself on current, major Federal employment laws. The DOL also maintains a list of all state labor offices, including their websites and contact information.

- The Society for Human Resources Management is also an excellent resource for keeping up to date on evolving state and local compliance requirements.

- Be sure your business has an employee recordkeeping system in place – be it digital, or physical, for keeping all employee documents organized, accessible and secure.

If your business isn’t currently utilizing Talent Management Software for online employee records management, you may want to consider partnering with a Human Resources Outsourcing company like a Professional Employer Organization (PEO).

Not only can a PEO help your company securely manage the new hire process and all related employee documents, but can also help you interpret which employment laws, regulations and other compliance issues pertain to your business. More important, a PEO helps to ensure your business is compliant and avoiding any costly, and oftentimes, crippling fines.

Gather Your Essential New Hire Forms, Including New Hire Tax Forms

From signing the initial job offer letter to enrolling in benefits, the typical new hire’s folder is often overstuffed and overwhelming. Be sure your new employees are completing required, time sensitive materials first. Here’s an overview of the major new hire forms you’ll need ready to go for day one.

Employment Contract:

After your new hire has formally accepted the job offer from your business (either verbally, or through a signed offer letter), you should have them to sign an employment contract. It’s best that you consult with a licensed legal professional to identify if this is necessary for your small business, and which protections and provisions you’d like in place for both your business and your employees. Special inclusions like non-compete clauses, protection of trade secrets and/or employee expertise may or may not be necessary for your business.

Employee Identification Form:

An employee identification form gathers basic information about your employee. It typically includes their home address and phone numbers, as well as a designated emergency contact and their information. It may also include a section about dependents (for insurance-related usage).

IRS Forms – I-9 and W-4:

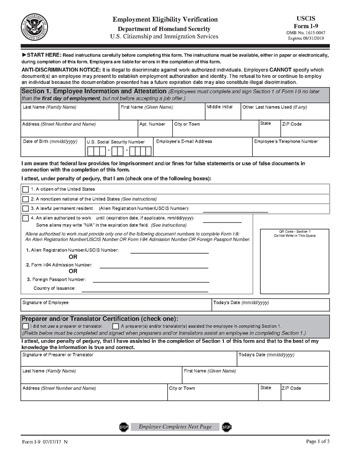

I-9 Form

Per the United States Citizenship and Immigration Services (USCIS), an I-9 “is used for verifying the identity and employment authorization of individuals hired for employment in the United States.

All U.S. employers must ensure proper completion of Form I-9 for each individual they hire for employment in the United States. This includes citizens and noncitizens. Both employees and employers (or authorized representatives of the employer) must complete the form.

On the form, an employee must attest to his or her employment authorization.” Read more about completing the I-9 form here, as well as required supporting employee identification.

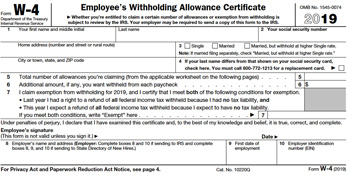

W-4 Form

Form W-4 is an IRS form that employees fill out to indicate to their employer how much federal tax they’d like withheld from their paychecks.

Employees also use a W-4 form to indicate how much state tax they’d like withheld. Be aware that this form just underwent changes in 2020. For more small business information about the I-9 and W-4, specifically for small business owners, please visit the IRS website.

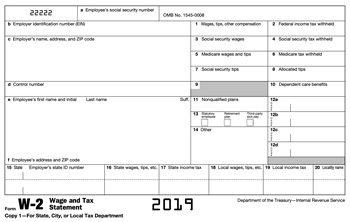

Special Mention – the W-2 Form

Employers are also required to file a W-2 by January 31st for the previous year (ending December 31st) for each employee they paid wages to and withheld tax from, along with sending a copy of individual W-2s to employees by January 31st.

While sending W-2 forms to employees manually is possible for small businesses with only a few employees, as your business begins to grow you’ll likely need to outsource this process to an accountant or utilize an HR Service Provider to automate the process. Learn more about the W-2 form.

Background Check Authorization Form:

A background check authorization form enables your company to verify that your prospective employee is who they say they are. The Society of Human Resources Management (SHRM) offers many resources in this area, including a sample background check policy and procedure letter. Many employers will conduct background checks on final candidates, or as a contingency for employment once a new hire has been offered a job.

Direct Deposit Form:

A direct deposit form enables your company to electronically transfer/deposit paychecks, benefits check or other payments to your employees’ individual bank accounts. An employee provides their bank routing number, as well as their checking account number to complete the form.

One of the best ways to streamline the entire new hire forms process is to utilize a paperless employee onboarding system, like those built into HR software for small business. Not only can this system help eliminate paperwork and ensure all forms are completed on time, but it can also enable your company to design a custom onboarding and employee development program, from training to surveys to storage of critical organizational documents.

Learn more about HR Outsourcing

Schedule a call to learn more about how HR outsourcing can help grow your business.

Contact VensureHRHow to Guide Your Employees Through Their New Hire Forms

Employees will need your guidance in completing their required forms. Here are a few tips for better facilitating and expediting the process.

- Provide your employees in advance with an initial list of new hire forms they’ll be receiving on their first day. Give a timeline as to what needs to be completed when. Try to stagger paperwork throughout the day if possible, combined with face-to-face meetings and other training and orientation plans. For less time-sensitive material (i.e., benefits-related), point out later due dates to help facilitate greater understanding of the material.

- Prepare your employees for their first day by letting them know what forms of identification are required to legally complete the hiring process. On the last page of the I-9 form is a list of acceptable documents that employees must bring to establish identity and employment authorization.

- Make sure your employee knows who to go to for questions regarding their new hire forms and associated policies and procedures. Have a list of contacts readily available for more complex questions related to taxes or benefits, or legal questions related to employment contracts.

If your business is struggling to design a successful employee onboarding process, or interpret and explain policies and procedures related to tax laws, benefits and other sensitive human resources (HR)-related areas, you may benefit from outsourcing your HR tasks to an HR Service Provider. They can help provide both the expert advice and the cutting-edge technology your business needs to get to the next level in successfully managing its employees.

Whether your business is just getting started, or rapidly growing, managing new employee forms can be an overwhelming, time-consuming task. Making sure your company is prepared, keeping informed and staying organized throughout the process is critical.

If you find yourself spending too much time managing new employee paperwork or other HR tasks, partnering with an HR Service Provider may be the right solution for your business. You’ll get access to cutting-edge HR software coupled with the expertise of the service provider to help you successfully manage that stack of new hire forms. It will also keep your business compliant with all laws and regulations while helping you find and retain the best employees by continually improving the employee experience.

This will will make your company more attractive to new hires, let you keep your most valued current employees, and position your business for greater growth and higher revenues in the months and years ahead.

New Employee Forms FAQ:

What new employee forms am I required to have completed as an employer?

Employers must have new employees complete an I-9 and W-4. Many employers will also have their employees complete an employment contract, employee identification form, background check authorization form, direct deposit form, employee handbook acknowledgement form, and other forms related to enrollment in benefits like health insurance and retirement plans. Your company may have additional, required new employee forms or additional authorizations that it may need to include in the onboarding process. Learn more about new employee paperwork.

Which new hire forms does an employer need to file with which U.S. agencies and when do they need to be completed?

Employers aren’t required to file a new employee’s I-9 with the USCIS, but they must have the completed I-9 on file within their own recordkeeping system within three business days of the date of hire (first day of work that would be paid). An employee’s I-9 must be stored for three years from the date of hire, or for one year after the date of termination. I-9s should be stored separately from an employee’s personnel file and must be made available for inspection by the Immigration and Customs Enforcement (ICE).

The W-4 must be completed and kept on file with the employer before the employee receives his/her first paycheck. Employers are not required to file W-4s with the IRS, but most keep them on record. Please note that IRS has published important information regarding changes to the 2020 W-4 form, and how this impacts employers and their employees. Please note that employers are required to file a W-2 by January 31st for the previous year (ending December 31st) for each employee they paid wages to and withheld tax from, along with sending a copy of individual W-2s to employees by January 31st.

Where do I find information about current federal employment laws?

Visit the United State Department of Labor website for more information. You may also consult with a licensed legal professional, or your Human Resources Outsourcing partner, like a Professional Employer Organization (PEO), who can help keep your business informed and compliant with required Federal laws, regulations and policies.

Where do I find information about state employment laws?

Contact your state or local labor office for more information or guidance. The United States Department of Labor provides a detailed list of contact information by state for commissioners, directors and secretaries of state labor departments and their websites. You may also consult with a licensed legal professional, or your Human Resources partner such as a Professional Employer Organization (PEO), who can help keep your business informed and compliant with required state laws, regulations, and policies.

How long should an employer keep employee records?

The United States Equal Employment Opportunity Commission (EEOC) requires employers to retain all personnel or employment records for at least one year. Employers must also keep all payroll records for three years. I-9s must be kept on file for three years following start date, or one year following termination. Additional requirements and record-keeping minimums are outlined in detail on the EEOC website. If your business is not currently utilizing Talent Management Software to assist with the facilitation and secure storage of new employee forms, it may be the right solution to ensure you are following current record-keeping laws and requirements.